Inside the BluSmart Scandal: ₹978 Cr Debt, ₹262 Cr Fraud & India’s EV Dream Shattered

A roller‑coaster expose of fraud, SEBI action, and the strategic errors that spelled disaster for India’s green mobility trailblazer.

TL;DR

BluSmart’s vision of zero‑emission, asset‑owned ride‑hailing in India ended abruptly in April 2025 when its affiliate’s founders were accused of diverting EV‑procurement funds to personal luxuries.

Asset‐heavy model drove a burn of over ₹20 cr/month and left the company unable to raise fresh capital.

Governance breakdown at Gensol (BluSmart’s leasing partner) triggered SEBI sanctions, barring its promoters from key roles, and froze operations across multiple cities.

Operational fallout stranded 10,000+ drivers and left customers waiting up to 90 days for refunds.

Key lessons: bake in transparent governance, map inter‑entity risks, and evaluate asset‑light vs asset‑heavy trade‑offs from day one.

The Promise: Electrifying India’s Rides

BluSmart launched in 2019 to offer 100% electric cabs, no surge pricing, and guaranteed availability in Delhi‑NCR, Bengaluru, and Mumbai.

Backed by BP Ventures and claiming ~9% Delhi market share, it marketed itself as a product that married sustainability with reliability.

Early customer feedback praised the consistent fares and guilt‑free carbon footprint, but beneath the surface, the capital demands were enormous.

Asset‑Heavy Model: High CapEx, Higher Risk

Unlike asset‑light rivals (Uber, Ola), BluSmart owned its fleet and built charging hubs. That meant:

₹20 cr+ monthly burn on vehicle leases, maintenance, and charging infrastructure.

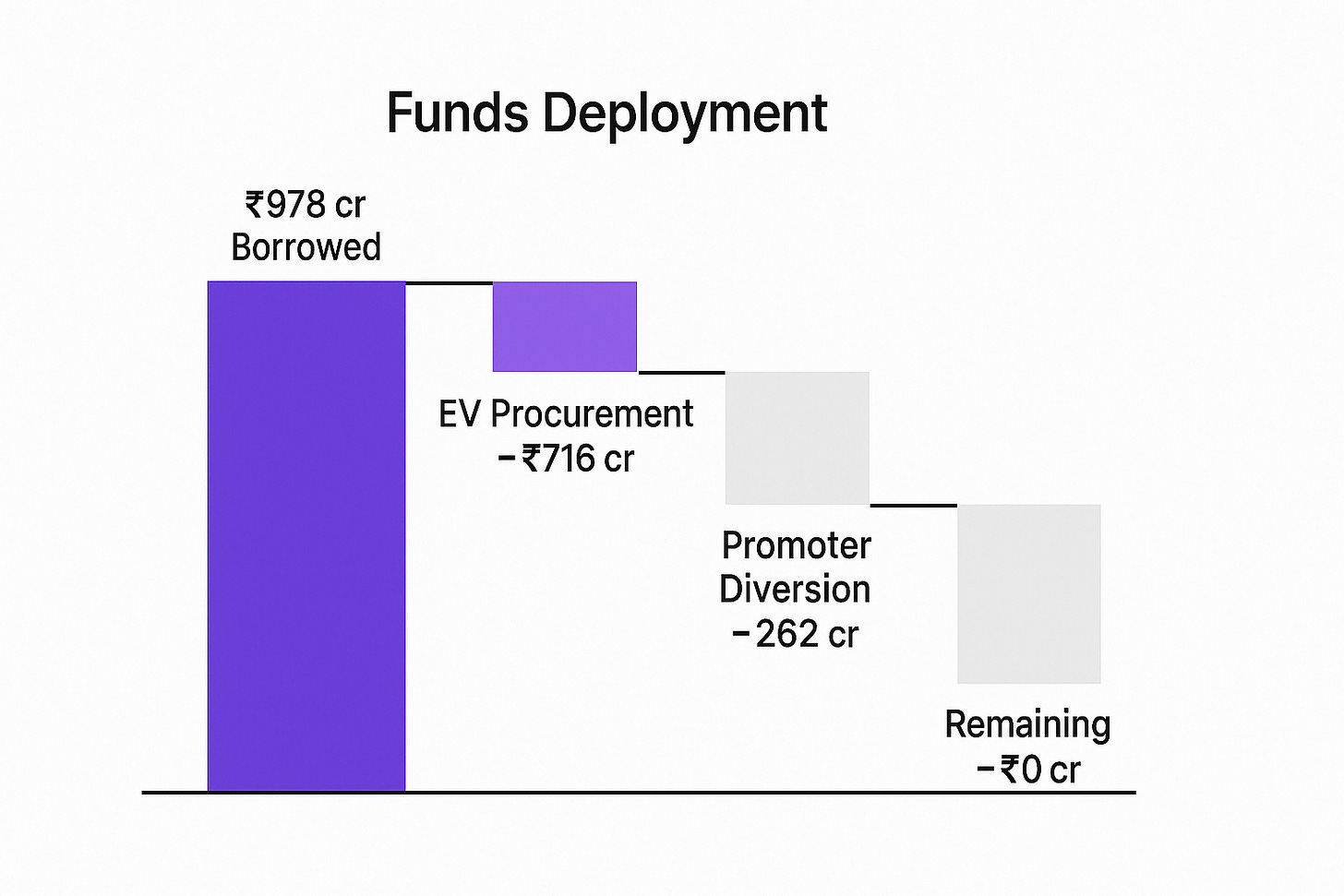

Debt‑financed growth: ₹978 cr borrowed by Gensol from IREDA/PFC to buy EVs for BluSmart.

Fundraising pressure: failure to secure a targeted $50 M funding round left cash flows untenable.

Why this matters, founders and PM:

Asset‑heavy products amplify product‑market fit risks with financial exposure. Always model your burn rate and fundraising runway against worst‑case fundraising scenarios.

Governance Breakdown: When Finance Becomes the Bottleneck

In mid‑April 2025, SEBI’s forensic audit revealed that Gensol founders (who also co‑founded BluSmart) diverted ₹262 cr from EV procurement loans into personal expenses—a luxury Manhattan apartment, golf equipment, and other perks. SEBI responded by:

Barring Anmol & Puneet Jaggi from top roles in Gensol.

Blocking a planned 1:10 stock split.

Freezing corporate controls pending a deeper probe.

This governance failure directly halted BluSmart’s access to new vehicles, triggering service suspensions.

Operational Fallout: From City Streets to Standstill

Within days of SEBI’s order, BluSmart:

Suspended operations at Delhi Airport and key zones across its three cities.

Left 10,000+ drivers without income, forcing them to abandon EVs at charging hubs due to salary delays.

Informed customers that refunds for in‑app wallets may take up to 90 days.

Builder takeaway: Operational resilience isn’t just about uptime; it’s about financial controls that prevent a single governance lapse from collapsing customer‑facing services.

Strategic Missteps & Risk Mapping

Entity entanglement: BluSmart and Gensol shared leadership without clear legal or operational firewalls—violations in one entity bleed into another.

Overlooking interdependencies: A product risk map would have flagged “fund diversion” as a high‑impact, high‑likelihood scenario given founders’ dual roles.

Neglecting alternative models: An asset‑light leasing partnership could have shifted capex risk to vehicle owners, reducing balance‑sheet exposure.

Final thought

Embed governance early: Treat financial controls as a core feature, not an afterthought.

Practice “risk-first” roadmapping: Map product components against governance, financial, and reputational vectors.

Choose capital structures deliberately: Weigh asset‑heavy advantages (control, quality) against strategic flexibility.

Design recovery playbooks: Have contingency flows for refunds, partner shifts, and workforce support.

The Road Ahead: Reimagining EV Mobility

BluSmart’s collapse doesn’t doom electrified ride‑hailing in India.

Instead, it highlights that sustainable products demand sustainable businesses. Future PMs in this space should:

Leverage partnership models with OEMs.

Build modular platforms that allow rapid shifts between owned and leased fleets.

Integrate real‑time governance dashboards into product analytics.

BluSmart’s fall is a cautionary tale: without transparent leadership and financial safeguards, even the most compelling product visions can unravel.

As builders, let’s bake governance into our product DNA, map risks holistically, and choose capital structures that align with our growth ambitions because in today’s capital‑intensive landscapes, product success and corporate integrity are inseparable.